Working-capital adjustments are a common type of purchase price adjustment, making it an integral component of Merger & Acquisition (“M&A”) transactions. For buyers, working-capital adjustments help ensure the business they procure satisfies the requirements for continued operation (going-concern basis). For sellers, working-capital adjustments help ensure they receive fair compensation. Working-capital adjustments represent the potential flexibility of a transaction, underlining the great importance of both parties understanding and agreeing to the structure and calculations of the transaction early in the process. With an agreed-upon structure, both parties should reach the economic outcome they desire.

Protecting Deal Value

In most private M&A transactions, even after the parties have arrived at the purchase price, there is still potential for financial moves before the deal closes. The seller can shift the company’s assets and liabilities in a way that may impact future cash flows without affecting the earnings. This shift has the potential to leave the purchase price unaffected. Furthermore, even if earnings are maintained, the pledged ratio of assets and liabilities may also shift. As a result, while earnings can constitute much of the backbone for a transaction, it should not completely overshadow other value considerations.

Working Capital Keyterms

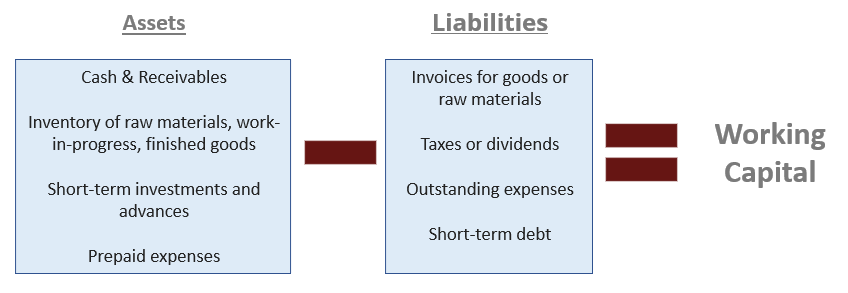

Before engaging in the negotiation of working-capital adjustments, buyers and sellers need to first understand the primary components.

Working capital: Accounts receivable (net of reserves) plus inventory plus prepaid expenses minus accounts payable and accrued liabilities—the sum of current assets over current liabilities. In M&A transactions, current assets may be comprised of inventory, cash, accounts receivable, and prepaid items. Current liabilities may consist of accounts payable as well as accrued expenses.

Inventory: Goods accrued before being sold to the end-user. The buyer and seller need to agree on whether inventory can also be described as the raw materials used to produce the finished goods, work-in-progress (WIP) goods (currently in production process), or goods in transit.

Cash: M&A transactions are commonly priced on a cash-free/debt-free basis. Consequently, cash and cash equivalents would be excluded from the calculation of working capital. In some cases, the buyer might want the additional safety of sufficient, immediately available operating cash at the time of closing to ensure continued operation of the business. In certain situations where the buyer is unable to immediately fund continuous operation on their own at closing, the seller could be required to leave a specified amount of petty cash in the business (credited in the working capital adjustment).

Accounts receivable: The balance of money owed to a firm for goods or services delivered or used but not yet paid for by customers—outstanding invoices or money clients owe the company. There are some variations for calculating accounts receivable such as accounts-receivable-reserve calculations. The buyer needs to be aware of the historical accounts-receivable practices employed by the seller to ensure both parties are evaluating numbers from the same perspective.

Accounts payable: The company’s obligation to pay off short-term debt to its creditors or suppliers, shown on the balance sheet as a current liability.

Prepaid items and accruals: A portion of the working capital commonly contains a miscellaneous blend of prepaid expenses, accruals, and prorations. Individually, these items are typically insignificant. However, the total of those items can add up to a significant amount, and their calculation and inclusion in the working capital total should be outlined and agreed upon.

Checks and Balances

As outlined by the above definitions, working capital adjustments are an offspring of buyer-and-seller protection checks and balances. Buyers involved with an acquisition that will continue in business for some future period need the assurance they will be able to meet the immediate working-capital requirements for the business.

Working-capital requirements and calculations have the potential to change throughout the deal. For example, financial statements based on events that occur after the initial deal structure can be adjusted as well. This would allow for an accounts-receivable-reserve adjustment to true up if, for instance, a substantial receivable is collected (or is no longer collectible) within a certain, small window after the statement has been made. Such adjustments will not be necessary if all parties agree that the adjustments need only account for the state of the transaction at closing and not after. Determining the adjustment only as of the applicable date can help prevent such an inconsistency.

Post-closing issues can also negatively impact the transaction process if pre-closing financials revolving around the adjustment target differ. To address this issue, both parties may choose to clearly define the method for determining each component in the adjustment. This may include a deduction in cash at close or purchase price to allow for working capital requirements of the business. Having the seller and buyer agree to consistent use of specific principles throughout the entire transaction will help protect the integrity of the deal structure.

Concisely defining the deal structure and working-capital adjustments early in the process will support a fair, equitable, and fluid transaction. Buyers and sellers must know the variables, structure, and fully understand their agreement to achieve the anticipated deal value.